World

The Real Cost of Letting Your Car Insurance Expire

We all have moments where life gets busy and things slip through the cracks. Maybe you forgot to update your credit card on file, or perhaps the renewal notice got lost in a stack of junk mail. But when that overlooked item is your car insurance, the consequences can be far more serious than a simple late fee.

Driving without insurance—even for a single day—is a gamble with high stakes. It’s not just about obeying the law; it’s about protecting your financial future. This article breaks down exactly what happens when your policy lapses, the legal and financial storms you might face, and the immediate steps you need to take to get back on the road safely. Policy legal structure may differ for each countries i was checking Dubai guidelines and later i checked for car insurance Qatar policy , and what i understood, there will differences to policy based on the country that you are living in.

The Immediate Consequence: You Are Driving Unprotected

The moment the clock ticks past the expiration date on your policy, your coverage ceases. There is no grace period for coverage itself. If you get into an accident five minutes after your policy expires, you are 100% liable for all damages.

This is the most dangerous aspect of a lapse. If you cause a crash, you will have to pay for:

- Repairs to the other driver's vehicle.

- Medical bills for anyone injured in the accident.

- Legal fees if you are sued.

- Repairs to your own vehicle.

These costs can easily climb into the tens or hundreds of thousands of dollars. Without an insurance company to shield you, your personal assets—your savings, your home, and your future wages—are on the line.

Legal Penalties: The Law Doesn't Take Breaks

Car insurance is mandatory in almost every state. When you let your coverage lapse, you are breaking the law. While you might think you’ll only get caught if you’re pulled over, many states now have electronic monitoring systems. These systems cross-reference vehicle registrations with insurance databases. If your VIN doesn't show an active policy, the DMV knows about it instantly.

Here are the legal penalties you could face:

Fines and Fees

The most common penalty is a fine. These can range from a manageable $50 to a painful $500 or more, depending on your state and how long the lapse has lasted. You may also have to pay reinstatement fees to the DMV to clear your record.

License and Registration Suspension

This is where a lapse becomes a logistical nightmare. States often suspend the vehicle's registration or the owner's driver's license if insurance isn't maintained. To lift the suspension, you’ll typically need to:

- Buy a new policy.

- Provide proof of insurance (often an SR-22 form).

- Pay a reinstatement fee.

Losing your license can affect your ability to get to work, which creates a domino effect on your finances.

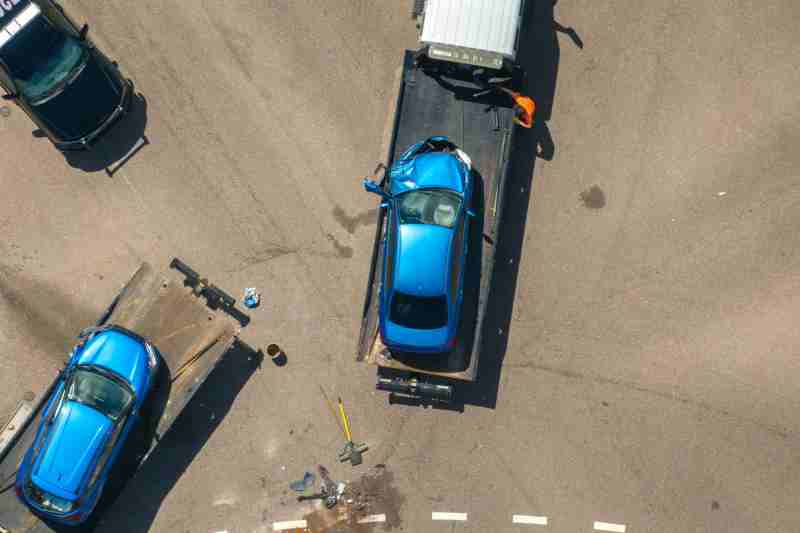

Impoundment

If you are pulled over and caught driving without insurance, police officers in many jurisdictions have the authority to tow and impound your car on the spot. Getting it back requires proof of insurance and payment of hefty towing and storage fees.

Jail Time

While rare for a first offense, repeat offenders or those involved in serious accidents while uninsured can face jail time.

The Financial Hangover: Higher Premiums in the Future

Beyond the immediate legal trouble, a lapse in coverage leaves a permanent mark on your insurance history. Insurance companies view drivers with gaps in coverage as "high-risk." They assume that if you let your policy expire once, you might do it again, or that you’ve been driving uninsured during the gap.

This "high-risk" label translates directly to your wallet.

- Loss of Discounts: You will likely lose "continuous coverage" discounts, which are rewards for maintaining insurance over several years.

- Higher Base Rates: When you apply for a new policy, your premium could jump significantly—sometimes by 20% or more—simply because you had a lapse.

- SR-22 Requirements: If the state requires you to file an SR-22 form (a certificate of financial responsibility) to reinstate your license, insurers will charge you extra for filing it, and your rates will likely be in the highest bracket available.

Repossession Risks for Leased or Financed Cars

If you lease your car or have a loan, your contract almost certainly requires you to maintain full coverage insurance. The lender wants to protect their asset.

If your insurance expires, the lender will be notified. They have the right to purchase "force-placed insurance" on your behalf. This insurance protects them, not you, and it is incredibly expensive—often two to three times the cost of a standard policy. The cost is added to your monthly car payment. If you fail to pay it, or if you repeatedly let your own insurance lapse, the lender has the right to repossess your vehicle.

What To Do If Your Insurance Has Already Expired

If you are reading this and realizing your policy is currently expired, don’t panic—but do act immediately. Every hour you wait increases your risk.

1. Stop Driving Immediately

Do not get behind the wheel. Park your car in a safe, legal spot (like a driveway or garage) where it isn't at risk of being towed for lack of registration tags, if applicable.

2. Contact Your Previous Insurer

Call your insurance company right away. If the lapse is very recent (within a few days or weeks), they might offer a reinstatement. This means they reactivate your policy without a gap in coverage, usually for a fee. You will have to pay the overdue premium, and you may have to sign a "statement of no loss," confirming you didn't have any accidents during the time you were unpaid.

3. Shop for a New Policy

If reinstatement isn't an option, you need a new policy. Be honest about your lapse when getting quotes. Lying about a coverage gap is insurance fraud and will cause the policy to be canceled later. You might have to look at "non-standard" carriers if major insurers reject you due to the lapse.

4. Resolve DMV Issues

Once you have proof of new insurance, check with your local DMV to ensure your license and registration are valid. Pay any necessary fines immediately to clear your record.

How to Prevent Future Lapses

The best way to handle an insurance lapse is to never have one. Here are three simple ways to safeguard your coverage:

- Set Up Autopay: This is the most effective failsafe. Link your payments to a bank account or credit card so you never miss a due date.

- Update Your Contact Info: Ensure your insurer has your current email and phone number so you receive renewal reminders.

- Pay in Full: If you can afford it, paying for six months or a year upfront eliminates the risk of missing monthly payments.

Conclusion

Letting your car insurance expire is a costly mistake that extends far beyond a simple administrative error. From legal fines and license suspension to the financial devastation of an uninsured accident, the risks are simply too high.

If you have lapsed, fix it today. If you haven't, set up safeguards now to ensure you stay protected. Keeping your insurance active is one of the easiest and most important ways to protect your financial well-being and your freedom on the road.

Meta Title: What Happens If Your Car Insurance Expires? (And How to Fix It)

Meta Description: Did your car insurance lapse? Learn about the legal penalties, financial risks, and higher premiums you face, plus immediate steps to get back on the road.

Source:

Click for the: Full Story

You might like

Close Menu

Close Menu